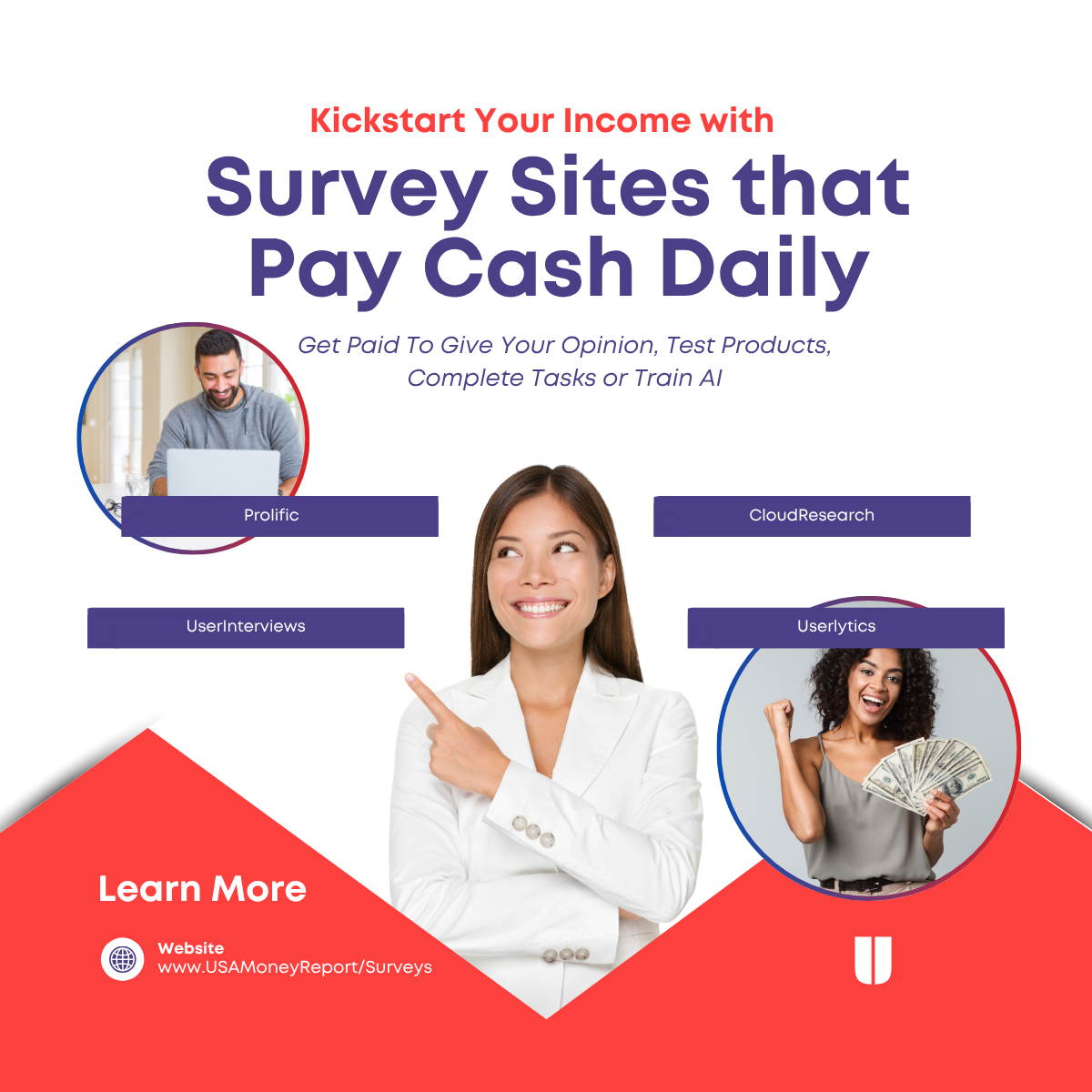

Discover the best survey sites that pay you real money with no gimmicks, just simple surveys and fast payouts!

Survey Sites That Pay

Prolific primarily offers academic and market research surveys that are designed to collect high-quality data from real people. The platform offers high-paying surveys. Cash-out daily with a minimum $6 but don’t worry, it’s fairly simple to get to the minimum cash-out amount.

Payment for studies can range from 0.20 cents to $35. What’s great about Prolific is you can filter out lower paying studies to request to receive studies that start at a particular amount. Prolific hosts a wide variety of studies including:

- External surveys: Many studies redirect participants to external survey platforms via links, while others use Prolific’s built-in survey builder.

- Questionnaire-based surveys: Covering topics like consumer behavior, psychology, social sciences, health, and more.

- AI training and evaluation tasks: Tasks to help improve artificial intelligence models.

- Behavioral experiments and cognitive tests: Often used in academic research.

- Custom screening surveys: Researchers can pre-screen participants to meet specific criteria before proceeding to the main survey.

Participants can expect a diverse mix of interesting, well-designed studies that contribute to scientific and market understanding-while earning extra cash for their time. Cash-out daily with a minimum $5. Types of surveys on CloudResearch Connect include:

- Academic research surveys: Conducted by university researchers or academic teams.

- Behavioral and Social Science Studies: Explore human behavior, attitudes, perceptions, and reactions.

- Market Research Surveys: Focus on consumer opinions, product feedback, or brand perception

- Longitudinal Studies: Requires participation over multiple sessions or time periods.

- Online Jobs and Tasks: Categorizing data, rating content, or completing decision-making exercises.

- Custom Screened Projects: Researchers can target specific demographics or participant characteristics, so you may be invited to specialized studies or mock jury duties based on your profile.

UserInterviews is a leading research recruiting platform that connects participants with companies and researchers seeking feedback. The studies target a wide range of participants, from everyday consumers to professionals in specific industries.

Payment varies based on the length and type of study, ranging from $5 for a quick survey to $200 or more for longer interviews or focus groups. The types of research studies and surveys they conduct include:

- Usability Testing: Try out websites, apps, or products and give feedback on user experience.

- In-Depth Interviews: One-on-one conversations (often via phone or video call) about your opinions, habits, or experiences.

- Focus Groups: Group discussions on specific products, services, or topics.

- Online Surveys: Answer questions about your preferences, behaviors, or opinions-these can be short or in-depth.

- Diary Studies: Track your experiences or usage of a product/service over a period of time.

- Product Testing: Receive and use a physical or digital product, then share your feedback.

- Field Studies: Participate in research conducted in real-world settings (less common, but available for some projects).

Dscout offers a diverse range of research opportunities that go beyond traditional surveys, focusing on interactive and projects called “missions.” Most missions pay between $15 and $150, though some can pay higher or lower amounts based on the time commitment and complexity required. Here’s what you can expect:

- Online Surveys: Answer questions about your experiences, preferences, and opinions.

- Product Testing: Evaluate prototypes, apps, or services before they hit the market.

- In-Depth Interviews: Participate in scheduled video or phone interviews with researchers.

- Diary Studies: Share your experiences over time by submitting photos, videos, or written responses.

- Retail Store Visits: Visit physical locations to assess products or shopping experiences (remote or in-person).

- Website and App Assessments: Test usability and provide feedback on digital platforms.

- Creative Tasks: Complete unique assignments designed to capture your authentic reactions and insights.

How Politics Affects Gig-Work

There are active and proposed policies at both the federal and state level that significantly impact gig workers, including those working for DoorDash, Uber. delivery services, or online platforms. These laws address worker classification, tax reporting, and access to benefits, and the landscape continues to evolve rapidly in 2025.

Labor Department Rules

- Department of Labor (DOL) Rule Changes:

As of May 2025, the DOL announced it will no longer enforce a Biden-era rule that made it harder for companies to classify workers as independent contractors. This move makes it easier for companies like DoorDash and Uber to continue using gig workers as independent contractors rather than employees, which affects benefits and labor protections.

Tax and Payroll Compliance

- Tax Reporting:

Gig workers are generally classified as independent contractors and must receive a 1099-NEC form if they earn $600 or more from a single business. This affects how gig workers report income and pay taxes

State Laws

- California’s Assembly Bill 5 (AB 5):

AB 5 continues to require companies to classify workers as employees unless they meet strict criteria, despite the Department of Labor May 2025 rule change. However, California voters passed Proposition 22, which exempts app-based delivery and ride-hailing drivers from AB 5. The California Supreme Court upheld this exemption in 2024, so app-based drivers remain independent contractors in California, though future legal challenges are possible

(Proposed) Federal Legislation

- Saving Gig Economy Taxpayers Act (2025):

This bill, recently reintroduced in Congress, aims to raise the IRS reporting threshold for 1099-K forms back to $20,000 and 200 transactions (from the current $600). If passed, it would reduce the tax paperwork burden for gig workers and people who use online payment platforms, meaning fewer gig workers would receive 1099-K forms and face tax complications for small or infrequent jobs. - Protect the Gig Economy Act (H.R.100):

This bill seeks to amend federal rules to protect the gig economy and small businesses that rely on independent contractors, though specific details are still under discussion.