The recent announcement of a China tariff deal has sparked intense debate in political and economic circles. As the U.S. and China agreed to a 90-day pause on most tariffs, many are asking: is this a genuine compromise or a clear capitulation by the United States?

Let’s break down the facts, the context, and what experts are saying.

What’s in the China Tariff Deal?

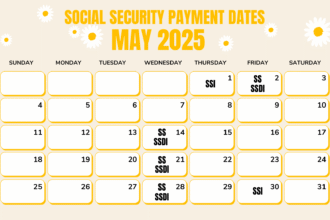

After months of escalating trade tensions and tit-for-tat tariffs, the U.S. and China reached an agreement to temporarily reduce the steep tariffs imposed on each other. According to the joint statement and reporting from multiple sources:

- U.S. tariffs on Chinese imports will drop from 145% to 30%.

- China will lower its tariffs on U.S. goods from 125% to 10%.

- The pause is set for 90 days while both sides continue negotiations.

This move comes after mounting pressure from global markets, business leaders, and economic data showing real pain on both sides.

Compromise or Capitulation? The Debate

Arguments for Compromise

Supporters of the deal argue that this is a pragmatic step back from the brink of a full-blown trade war. The agreement:

- Prevents Economic Catastrophe: With supply chains disrupted and fears of inflation and shortages, the deal averts the worst-case scenario for both economies.

- Creates Space for Negotiation: The 90-day window allows both sides to negotiate a more sustainable long-term arrangement.

- Addresses Non-Tariff Barriers: U.S. officials highlight a focus on opening China’s markets and tackling non-tariff barriers and subsidies, not just headline tariffs.

Arguments for Capitulation

Critics, including several economic commentators, see the deal as a clear retreat by the U.S. administration:

- China Withstood the Pressure: Despite punishing tariffs, Chinese exports remained resilient, and Beijing appeared ready to “wait out” the U.S. strategy.

- U.S. Markets Forced the Issue: Sharp declines in U.S. stock and bond markets, along with warnings from business leaders, pressured the administration to act.

- No Major Concessions from China: The deal lacks significant new commitments from China, and some retaliatory measures (like rare earth export controls) remain in place.

- High Tariffs Remain: Even after the reduction, a 30% tariff is still historically high and may continue to fuel inflation and uncertainty.

The Strategic Context

Both sides insist they do not want a full economic decoupling. However, the U.S. is now openly discussing “strategic decoupling” in sectors like steel, semiconductors, and pharmaceuticals, aiming for greater self-reliance after the supply chain shocks of recent years.

Yet, the deal’s critics argue that the U.S. approach of acting unilaterally-rather than building a broad coalition with allies-left it isolated and forced into a weaker negotiating position.

Market Reaction

The announcement triggered a surge in global stock markets, as investors welcomed the de-escalation. However, business owners and analysts warn that the 90-day window and remaining high tariffs still create significant uncertainty, especially for small and mid-sized companies.

Conclusion: A Pause, Not a Peace

The China tariff deal is best seen as a temporary truce, not a final settlement. Whether history judges it as a wise compromise or a reluctant capitulation will depend on what happens in the next 90 days. If the U.S. can leverage this pause into meaningful reforms and market access, it may yet be seen as a strategic retreat. If not, critics will likely remember it as a moment when economic and market realities forced a dramatic policy reversal.