During the 2024 campaign, Donald Trump and congressional Republicans made a bold promise to America’s seniors: no more federal taxes on Social Security income.

But as the House GOP’s new tax bill moves through Congress, that pledge has quietly morphed into something much less sweeping; a temporary $4,000 tax deduction that’s left many retirees asking, “Where’s the real relief?”

No Tax On Social Security

President Trump’s vow to eliminate taxes on Social Security was a headline-grabber, especially for the millions of retirees who have watched their benefits shrink under the weight of federal taxes. Currently, up to 85% of Social Security benefits can be taxed, depending on overall income, and about 40% of recipients pay some federal tax on their retirement checks.

But when the House Ways and Means Committee unveiled its nearly 400-page “One, Big, Beautiful Bill,” the much-anticipated Social Security tax repeal was nowhere to be found. Instead, seniors got a consolation prize: a $4,000 “senior bonus” tax deduction, available from 2025 to 2028 for those aged 65 and up.

$4,000 Deduction Instead of No Tax on Social Security

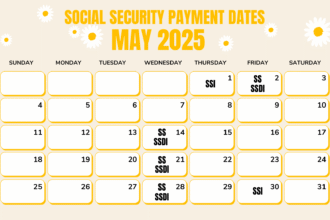

- The $4,000 deduction applies to both standard and itemized filers, but only if your adjusted gross income is less than $75,000 (single) or $150,000 (joint).

- For every dollar above those limits, the deduction phases out at a rate of 4%. For example, if a single filer earns $80,000, $5,000 over the limit, their deduction shrinks by $200, leaving them with only $3,800.

- The deduction is temporary, lasting just four years from 2025 through 2028.

For many lower- and middle-income seniors, the deduction might translate to a tax savings of about $480 per year, this amount is less than a quarter of a typical monthly Social Security check. For those who rely solely on Social Security, the benefit is even smaller, and for higher-income seniors, it disappears entirely.

Why Not Just End Social Security Taxes?

The answer is simple: money. Eliminating federal taxes on Social Security would cost the government about $1 trillion over a decade, compared to just $90 billion for the $4,000 deduction. Lawmakers also face procedural hurdles like the Byrd Rule, which blocks certain Social Security changes in budget bills and concerns that cutting this tax would hasten the insolvency of the Social Security trust funds.

Reaction: “Helpful, But Not a Significant Deal”

Senior advocates and policy experts are underwhelmed. Shannon Benton of the Senior Citizens League called the deduction “modest” and noted that it doesn’t address the core fairness issue of taxing Social Security at all. Richard Johnson of the Urban Institute described the benefit as “helpful, but it’s a minor assistance. For the majority, it’s less than a quarter of one month’s Social Security check. It’s not a significant deal”.

Final Thoughts

Seniors were promised a tax-free Social Security future. What they got instead is a temporary, modest deduction that leaves the vast majority still paying taxes on their hard-earned benefits.

For many retirees, the $4,000 “boost” feels less like a windfall and more like a bait and switch, a reminder that in Washington, campaign promises are easy, but real relief is much harder to deliver.

Sources: Newsweek, MarketWatch, TheStreet, CNBC, CBS News

- https://www.marketwatch.com/story/a-new-senior-bonus-could-give-older-adults-a-4-000-tax-break-heres-who-would-qualify-327a6cba

- https://www.newsweek.com/no-tax-social-security-house-gop-budget-spending-bill-2072068

- https://www.cbsnews.com/news/trump-tax-cuts-overtime-social-security-senior-deduction/

- https://www.newsweek.com/social-security-4000-tax-break-republican-bill-2071464

- https://www.cnbc.com/2025/05/14/republicans-trumps-tax-bill-salt.html