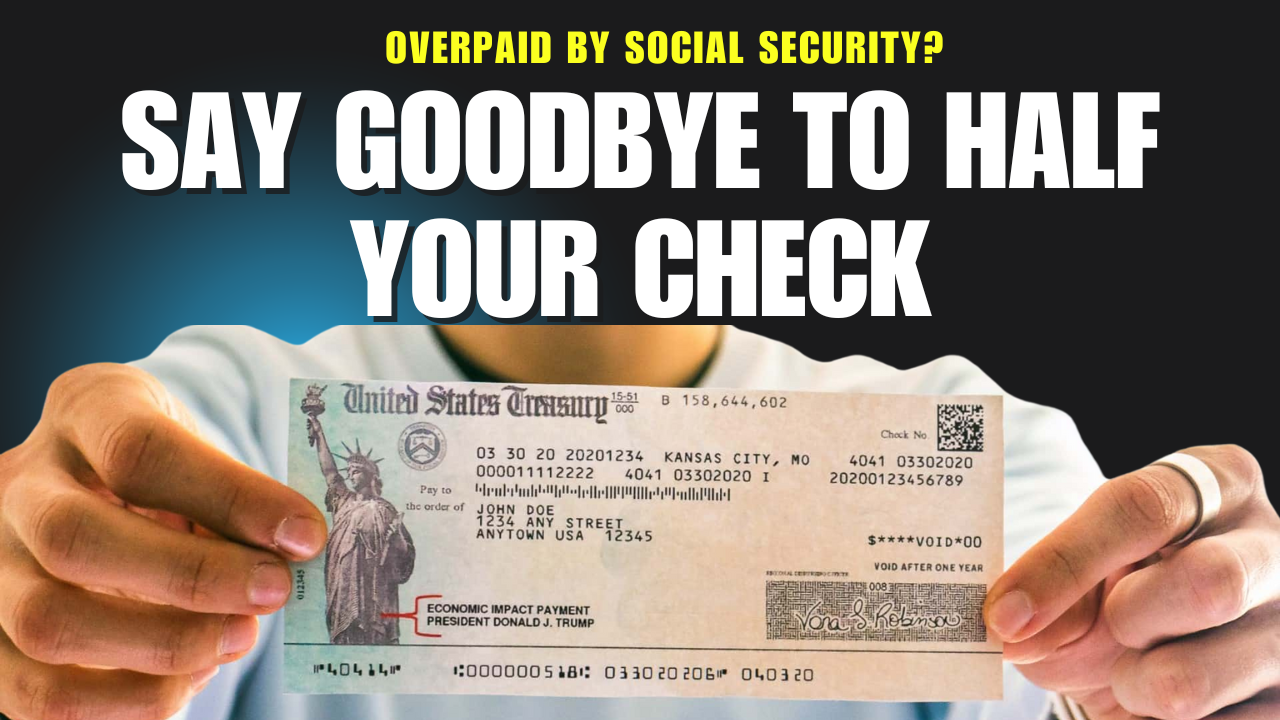

Imagine checking your bank account on payday, only to find your entire Social Security check is gone.

That’s the harsh reality millions of Americans faced when the Social Security Administration announced it would start withholding 100% of benefits from anyone flagged as “overpaid”. This meant an entire monthly check could be taken until the overpayment was repaid. But that was in mid-April.

So, after intense public backlash, the Social Security Administration reversed the 100% withholding rule by the end of April. The new withholding rate is now up to 50% of a recipient’s benefit to recover overpayments.

The reversal applies to anyone who received an overpayment notice sent on or after April 25, 2025. Those letters were sent nationwide and affected millions of Social security recipients.

While this is good news, I would dare to say that a 50 percent clawback is still a problem for most people, especially since in 2024, the Biden Administration limited clawbacks to only 10% of monthly benefit checks.

For anyone living on a fixed income, the current 50% withholding policy might be devastating.

Just think about it. Suddenly, people who rely on Social Security to pay for rent, groceries, or medicine are left with only 50% of their regular income.

The stress and confusion are overwhelming, especially since many recipients often have no idea they have been overpaid until they get a notice from Social security.

Bill Sweeney of AARP says: “We are glad to see the SSA taking a step in the right direction here. Oftentimes, these mistakes are actually Social Security’s fault — and slapping people with huge penalties for mistakes other people made just isn’t right.”

That’s right. Overpayment is often the fault of the Social Security Administration itself, not the individual recipient.

So that’s it folks. If you receive an overpayment notice, Social security can only clawback up to 50% of your check but also know that you don’t have to accept a clawback notice as-is.

If you get a notice, immediately appeal to request a lower withholding rate, or even ask for a waiver if repayment would cause financial hardship or if the overpayment wasn’t your fault.

Just be sure to act quickly to protect your income and avoid losing half of your Social Security check.