Digital payment wallets have rapidly transformed the way Americans manage and spend money, evolving from early online payment systems to today’s seamless, smartphone-based solutions.

The roots of digital wallets in the United States trace back to the late 1990s with the launch of PayPal, which made online transactions accessible and secure for the masses.

The modern era of mobile wallets began in 2011 with Google Wallet, followed by Apple’s Passbook in 2012 and the launch of Apple Pay in 2014, marking a shift toward contactless, phone-based payments.

Over the past decade, digital wallets have moved from a niche innovation to a mainstream payment method, accelerated by the demand for contactless transactions during the COVID-19 pandemic and now serving as a staple in daily commerce for millions of Americans

Pros and Cons of Switching to a Fully Digital Payment Wallet

Pros

Convenience and Speed: Digital wallets allow you to make payments quickly with just a tap or scan, both online and in physical stores, eliminating the need to carry cash or physical cards

Enhanced Security: Advanced encryption, tokenization, and biometric authentication (like fingerprints or facial recognition) protect your financial data and reduce the risk of theft or fraud compared to carrying physical cards or cash

Centralized Management: You can store multiple payment methods, loyalty cards, tickets, and coupons in one app, making organization and access easier

Transaction Tracking: Digital wallets automatically record your transactions, helping you monitor spending and manage your budget

Financial Inclusion: They provide access to payments and banking services for people without traditional bank accounts, supporting broader financial inclusion

Cons

Merchant Acceptance Limitations: Not all retailers, especially small businesses or those in rural areas, accept digital wallet payments, which can restrict usage

Dependence on Technology: You need a compatible device and reliable internet connection. Losing your phone, running out of battery, or experiencing technical issues can leave you without access to your money

Security Risks: While generally secure, digital wallets are still vulnerable to cyberattacks, phishing, or malware if your device or account is not properly protected

Privacy Concerns: Digital wallets track and store transaction data, which could be accessed by third parties or used for targeted advertising

Regulatory and Compatibility Issues: Differences in regulations and standards can affect wallet functionality and availability, particularly when traveling or dealing with cross-border transactions

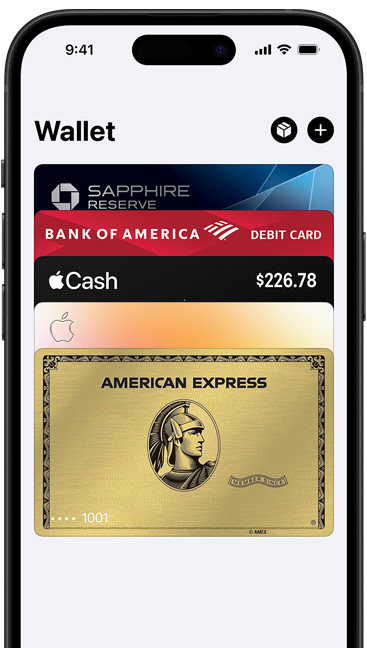

Top 10 Digital Wallets in the United States (2025)

The leading digital wallets in the U.S. for 2025 are:

- Apple Pay – The dominant digital wallet in the U.S., with the largest user base and merchant acceptance, especially among iPhone users.

- Google Wallet (Google Pay) – Widely used on Android devices, offering seamless integration with Google services and contactless payments.

- Samsung Pay – Popular among Samsung device owners, known for its compatibility with both NFC and older magnetic stripe terminals.

- PayPal – A longstanding leader in online payments, also supporting in-person and peer-to-peer transactions.

- Venmo – Owned by PayPal, Venmo is favored for social, peer-to-peer payments, especially among younger users.

- Cash App – Offers peer-to-peer payments, banking features, and even investing, with strong popularity among younger demographics.

- Zelle – Integrated with major U.S. banks, enabling instant, direct bank-to-bank transfers.

- Amazon Pay – Convenient for Amazon shoppers, allowing payments on and off the Amazon platform.

- Alipay – A global giant gaining traction in the U.S., especially among international travelers and businesses.

- Skrill – Noted for international transfers and multi-currency support, appealing to users with cross-border needs.

These wallets are recognized for their security, convenience, and broad acceptance, reflecting the preferences and habits of American consumers in 2025.

Final takeaway

Switching to a fully digital payment wallet in the USA offers significant convenience and security benefits, but it also introduces new risks and limitations, especially regarding acceptance, technology dependence, and privacy.